Canadian artificial intelligence (AI) and machine learning healthcare company Treatment.com AI Inc. (TRUE:CSE; TREIF:OTCMKTS) noted it is watching Prime Minister Justin Trudeau's announcement of an AI fund and strategy for the sector this week closely.

The federal government is planning CA$2.4 billion in its next budget toward building up AI adoption.

"We want to help companies adopt AI in a way that will have positive impacts for everyone," Trudeau said, noting that CA$200 million of the proposed funding will specifically go toward boosting the adoption of AI in sectors like agriculture, clean technology, and healthcare.

Treatment.com AI, which is using AI to positively disrupt the healthcare sector, said it welcomed the announcement.

The World Health Organization said that healthcare accounts for as much as 11% of GDP, or US$9 trillion. According to Statista, the healthcare AI market was worth about US$11 billion worldwide in 2021 and is forecasted to hit US$188 billion by 2030, a compound annual growth rate (CAGR) of 37% from 2022 to 2030.

Technical Analyst Clive Maund wrote that the company "should have a very bright future" as "the growth potential of this industry is enormous."

Treatment.com AI Chief Executive Officer Dr. Essam Hamza, said, "Our healthcare systems are crying out for evolution," and AI "has a significant opportunity to positively disrupt healthcare."

"The future of healthcare delivery is going to look completely different than what it looks like today, through increased utilization of credible and pertinent AI solutions like what we’ve created at Treatment.com AI," Hamza said.

Technical Analyst Clive Maund wrote in a February posting that the company "should have a very bright future" as "the growth potential of this industry is enormous."

Analyzing Treatment's charts, he found that not only was the growth potential there, but "with a breakout from the base pattern looking increasingly likely soon, the stock is rated a Strong Buy for all timeframes, and the upside potential from the current historically low level is very substantial, especially in percentage terms."

The Catalyst: Streamlining Healthcare Experiences

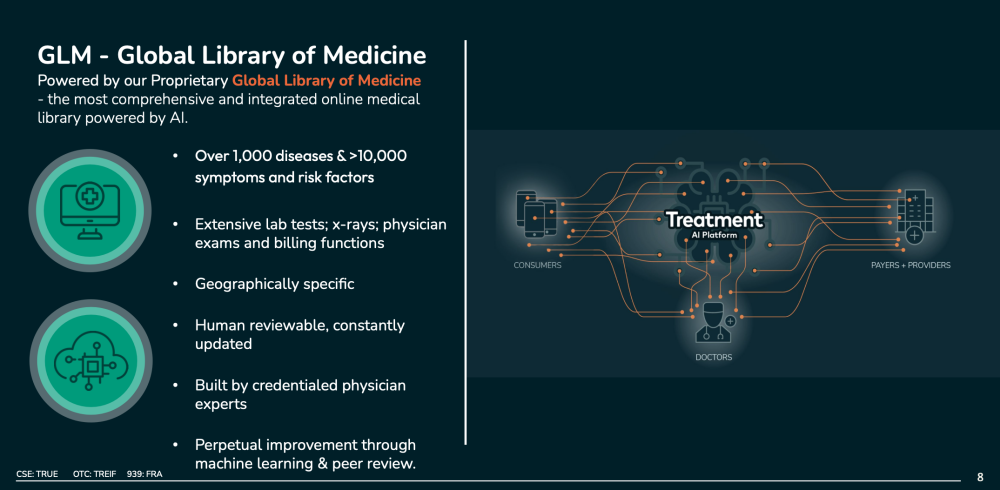

Treatment.com AI said its platform, the Global Library of Medicine (GLM), which uses AI to streamline healthcare experiences for patients and doctors, includes more than 1,000 diseases and more than 10,000 symptoms and risk factors.

The software can be integrated into a company's existing platform, helping doctors triage and diagnose patients quicker without compromising accuracy. They can even order lab tests electronically at the same time. The company is also using its platform (which is a protected source not exposed to outside influence like other generative AI databases) to help train new doctors and plans to also introduce a "doctor in a pocket" solution from the technology.

The software can be integrated into a company's existing platform, helping doctors triage and diagnose patients quicker without compromising accuracy. They can even order lab tests electronically at the same time. The company is also using its platform (which is a protected source not exposed to outside influence like other generative AI databases) to help train new doctors and plans to also introduce a "doctor in a pocket" solution from the technology.

Hamza, who came to Treatment.com AI after founding and leading CloudMD to more than CA$100 million in annual sales, said the first place many patients go to get help is Google, which gives them results that can be "incredibly inaccurate."

"One billion people do that a day," he said. "Most people get the worst type of information, and they come into my clinic and say, 'I think I have this; I want to be tested for this rare disease."

Traditional AI chatbots can be even worse, Hamza said since they "scrape the internet for any information, … (and) they don't really decipher it," which also leads to inaccuracies.

"It's not good enough to even be like 50%, or 60%, or 70%, or even 80% accurate in medicine; you have to be pretty close to well over 90% accurate to give any value to medical information," Hamza noted.

High Diagnosis Success Rate

Patients increasingly lack access to doctors, have shorter visits with them when they do get in the door, and see their premiums go up to cover for industry fraud that costs billions.

Treatment.com AI's GLM platform is geographically specific and recognizes that the "most likely diagnosis can vary" depending on where a patient lives. While it utilizes AI and machine learning, the GLM is curated and evaluated by hundreds of clinicians globally to make sure it is accurate.

Treatment.com AI's platform includes medical interviews, notes sent to providers, suggestions for testing, and recommended treatments after diagnosis is given.

A working demo of the company's app shows the AI asking a series of questions of the patient about their symptoms, even providing them with body diagrams to click on "where it hurts." For students, the technology can also simulate patients and help users diagnose them with a 92% success rate, the company said.

"A non-medical undergraduate, using Treatment's AI app, accurately diagnosed 11 out of 12 simulated patients during the OSCE, an essential diagnostic competency exam in medical education," Treatment.com AI noted in its investor presentation.

The company already has a partnership serving students at the University of Minnesota Medical School. Hamza said the company is in discussion with 52 organizations, including 27 medical schools, to use the platform. One of the possible partners services as many as 100 million patients per month.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Treatment.com AI Inc. (TRUE:CSE; TREIF:OTCMKTS)

Hamza noted in a release on Monday that the company looks forward "to participating in imminent discussions with the federal government" about the possibilities for AI in Canada.

Ownership and Share Structure

According to Reuters, two insiders own 13.12%, or 4.87 million (4.87M) shares, of Treatment.com AI. They are Chief Medical Officer, Chairman and Director Dr. Kevin Peterson with 10.35% or 3.84M shares and John Fraser with 2.76% or 1.03M shares.

Retail investors own the remaining 86.88%. There are no institutional investors currently.

The company has 38.08 million outstanding shares and 33.2 million free-float traded shares.

Its market cap is CA$23.38 million, and its 52-week trading range is CA$0.10 to CA$1.20 per share.

| Want to be the first to know about interesting Life Sciences Tools & Diagnostics, Medical Devices, Healthcare Services and Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Treatment.com AI Inc. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Treatment.com AI Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Contributing Author Disclosures:

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.